Heads up: Your business model doesn’t need to be a one hundred page document you generated out of an online template. It doesn’t need to break down how you’ll capture 1% of a billion dollar market or identify your nine different revenue streams.

Heads up: Your business model doesn’t need to be a one hundred page document you generated out of an online template. It doesn’t need to break down how you’ll capture 1% of a billion dollar market or identify your nine different revenue streams.

A successful, healthy, and profitable business model is a lot more straightforward than that.

At its core, your business is a relationship between four key parts:

- Revenue

- Direct Costs

- Overhead

- Profit

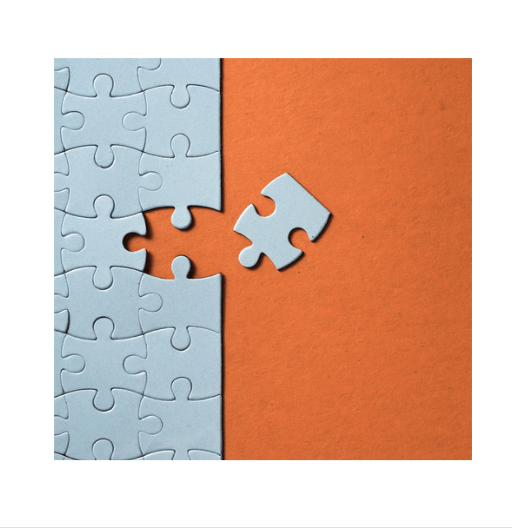

Your business model is how these four parts fit together, sort of like a jigsaw puzzle. Finding the right way to click all these pieces together is the key to scaling your business as far as you want to take it. Here are are our top three tips to do that:

Put profit first

Standard accounting practice and business advice would tell you to use the following formula when looking at your business:

revenue – direct costs – expenses = profit.

But Mike Michalowicz wants you to turn that formula on its head. In his book, ‘’Profit First’, Michalowicz explains the benefits of looking at your business model in reverse order, starting with your profit. That would look something like this:

revenue – profit = expenses

Once you set aside money for a specific profit goal, plus taxes and owner’s compensation (that’s right: paying yourself for your hard work is a priority, too!), what do you have left for operational costs? How can you run your business to meet those costs?

Using this formula, profitability is possible no matter the scale of your business. If you haven’t already, I highly recommend checking out Mike’s book, Profit First, to learn more.

Hit that magic ratio of CLV:CAC

Your Customer Lifetime Value (CLV) is the total income your business can expect to generate from a single customer, not just on a sale-by-sale basis but throughout the entirety of their relationship with you. You can calculate your CLV using the formula:

CLV = Average Transaction Size x Number of Transactions x Retention Period

For example, let’s say you’re an influencer whose campaigns sell for an average of $15,000. Most brands engage you for two campaigns a year over an average period of three years. That’s a CLV of $90,000.

Your Customer Acquisition Cost (CAC) is the average amount of money you spend gaining a new customer. You can calculate your CAC using the formula:

CAC = (cost of sales + cost of marketing) / new customers acquired

One of the most important steps of building a healthy business model is monitoring your CLV to CAC ratio. We recommend that folks aim for a CLV:CAC ratio of 3:1. For the influencer we discussed above, that could mean a CAC of tens of thousands if it yields those kinds of relationships.

If you’re just starting your creative business, spending that much money on sales and marketing activities can feel scary. But think of it like this: if I told you there was a machine at the arcade that, for every one coin you put in, you got three back, would you play that game?

You would. Probably all day. Because you’re getting a great return for your investment.

If you’re below the 3:1 ratio, you need to look at the effectiveness of your marketing. This means you’re spending money in a way that’s not generating a return, and there are changes you can make to decrease your CAC.

Being above the 3:1 ratio isn’t ideal either. This means you’re missing out on generating even more money. Don’t pinch pennies and sell yourself short of your potential. Invest in your customer acquisition costs until you hit that 3 to 1 level, and your business will be in the perfect position to continue scaling up.

Create recurring revenue streams

Nowadays, there’s a subscription for everything: your toothbrush, your groceries, your vitamins, your toilet paper. Whatever it is, people are looking for fixed, predictable planning so they can always have the products they love on hand.

On top of being helpful and attractive to your clients, a recurring revenue stream is hugely beneficial for your business. They help you:

- Create consistent, expected cash flow

- Boost your business value

- Build customer loyalty and brand recognition

- And free you from being solely reliant on one off sales

You might think a recurring revenue stream isn’t possible in your business, but there are innovative and creative ways to introduce recurring revenue in almost every industry out there, especially for creative businesses. Spend some time brainstorming. You may surprise yourself!

For more help, you can also check out our Revenue Stream Alternatives worksheet, which breaks down over two dozen ideas for generating income and strengthening your business model. This worksheet, plus an in depth look at all the key steps to start and scale your dream creative business, can be found in our masterclass-style course, Minding Your Business: The Creative Business Bootcamp.

READY TO START MINDING YOUR BUSINESS?

Sign up for our free business bootcamp today!