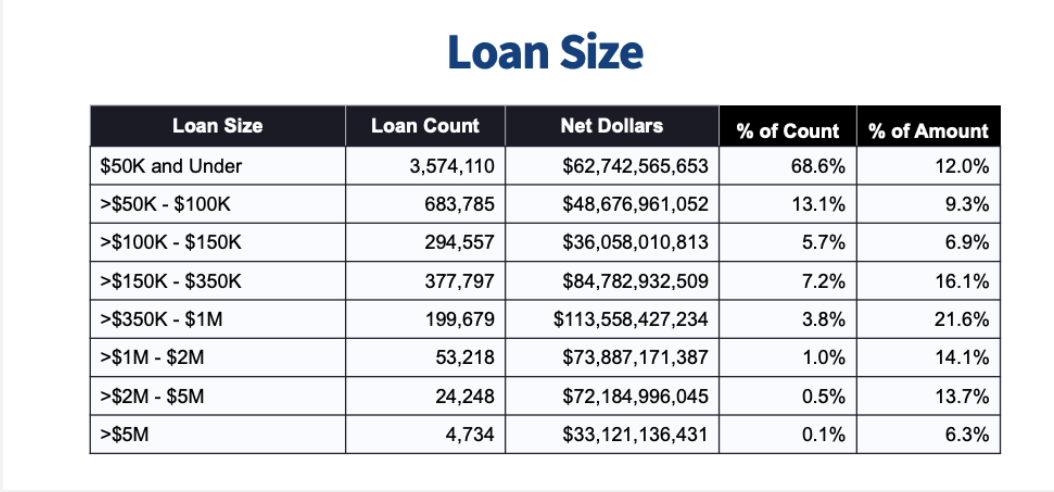

After a lot of debate, wondering, and speculation, the SBA announced on October 8th that there would be a new process for companies that received PPP loans of $50,000 or less. According to data presented by the SBA in previous releases, these smallest size loans represent roughly 3.5 million of the total loans issued, or 68.6%. While creating an even more streamlined version of forgiveness is great news to 3.5 million business owners, it’s also a huge relief to the SBA, whose administration and oversight on those forgiveness apps just got a whole lot easier.

In their latest announcement, the SBA shared a new streamlined form for these small PPP loans of $50k or less: the Form 3508S. You can access Form 3508S directly by using this link here. And instructions for Form 3508S are available here.

In short, the new form is about as close to automatic forgiveness of PPP loans as you could get. If you’re familiar with the long-form application or even the EZ form that followed, this simplified 3508S eliminates ALL forms of math and financial reporting and allows the business owner to simply certify to all the written attestations that are required. In plain language: they’re asking you to certify that you used the money for the purposes you agreed to and you generally “did the right thing.”

So what are the five things you need to know about Form 3508S and the simplified forgiveness process?

-

EIDL Advance: You’ll still need to report the EIDL advance you received (remember, that was $1k/employee up to a max of $10k). While the EIDL and the PPP originally had nothing to do with each other, the SBA has confirmed since that they are going to subtract any EIDL advance you received from the forgivable amount of your PPP loan. Surprised? We all were. And there isn’t anything in the guidance around this newest simplified forgiveness process to indicate that they’re shifting gears around that.

-

Documentation: While the paperwork just got a lot easier, and there are fewer numbers to crunch, this form doesn’t get rid of the requirement to produce documentation of payroll costs. So hang on to those payroll reports, tax forms, and other sources of validation because your lending institution will still be asking for them.

-

Free Pass: The ruling on this simplified approach specifically states that even if you would have had a reduction based on FTE headcount reducing, or reductions in wages or salary you will still get full forgiveness under the new form. Congratulations!

-

Use of Funds: You’re still attesting to having used the funds in the appropriate manner, including no more than 40% on non-payroll related items and counting no more than $20,833 in owner compensation or 2.5 months’ worth of 2019 compensation levels, whichever is lower. So be prepared to back up those calculations if asked.

-

Lender is Compelled: There’s also some language in the notice that indicates that lenders must allow for this simplified approach to forgiveness applications—even if and especially since they have often built their own process to collect this data. Most of the big banks have been waiting for this shoe to drop, and that’s exactly why they haven’t released their application process out to their loan recipients yet. But now that we know the simplified process, I’d expect to start seeing more of them reaching out to invite you to apply for forgiveness soon.

If you’re looking for assistance with your PPP forgiveness app and have a business in the creative or entertainment industries, drop us a line to see if we can assist. Good luck!