Filing your taxes on time is important, but it’s not always easy. If you’re a creative business owner, you may have a lot of different income sources and deductions to keep track of. It’s no wonder that many creative business owners end up filing extensions and/or paying tax penalties. In this blog post, we’ll review […]

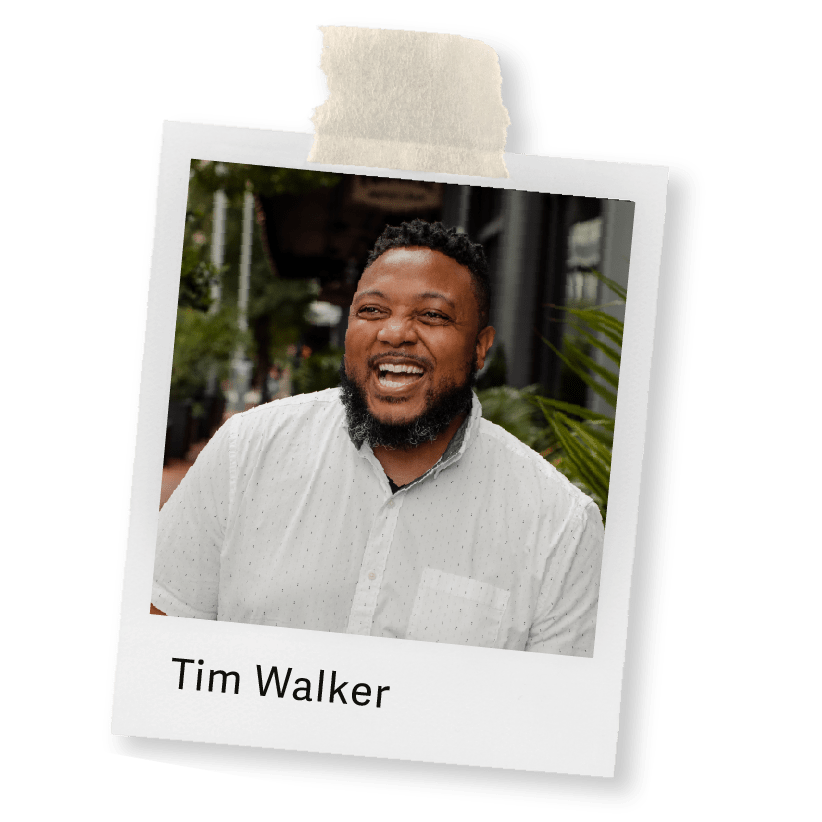

Timothy Walker

Senior Accountant

Timothy’s aim is to ultimately free up the time of his clients so they can focus on the things they’re passionate about. With a great eye for detail and overarching vision, he’s behind a lot of our client processes and makes sure they get the service they’re looking for. A cool fact about Timothy is he was once a ball-boy for the Chicago White Sox! An even cooler fact is his own grandmother has a train station named after her, right outside their stadium. When he’s not checking in with his clients, Timothy is all about his beautiful family. Oh, and snacks, he loves really good snacks.

Timothy’s favorite thing about Revel is, undeniably, the team. He’s a huge team player and loves how everyone truly does support one another. We love that you’re part of it all, Timothy.